Customers of cryptocurrency platforms FTX, Celsius Network and Voyager Digital are reportedly seeking to sell their cryptocurrency claims at discounted prices in order to avoid waiting for potentially long bankruptcy proceedings. The three platforms have seen hundreds of customers burned by their collapses, and these customers are now looking to sell their claims in order to receive some of their money back immediately, rather than waiting months or even years to see what they might recover through bankruptcy proceedings.

According to Cherokee Acquisition, a bankruptcy claims broker and buyer, customers and other creditors holding roughly $1 billion in FTX claims and around $100 million in Celsius claims have expressed interest in selling their claims through Cherokee’s online market. Cherokee’s platform allows customers to sell their claims in a transparent manner, which creates competition among potential buyers and can result in higher returns for the sellers.

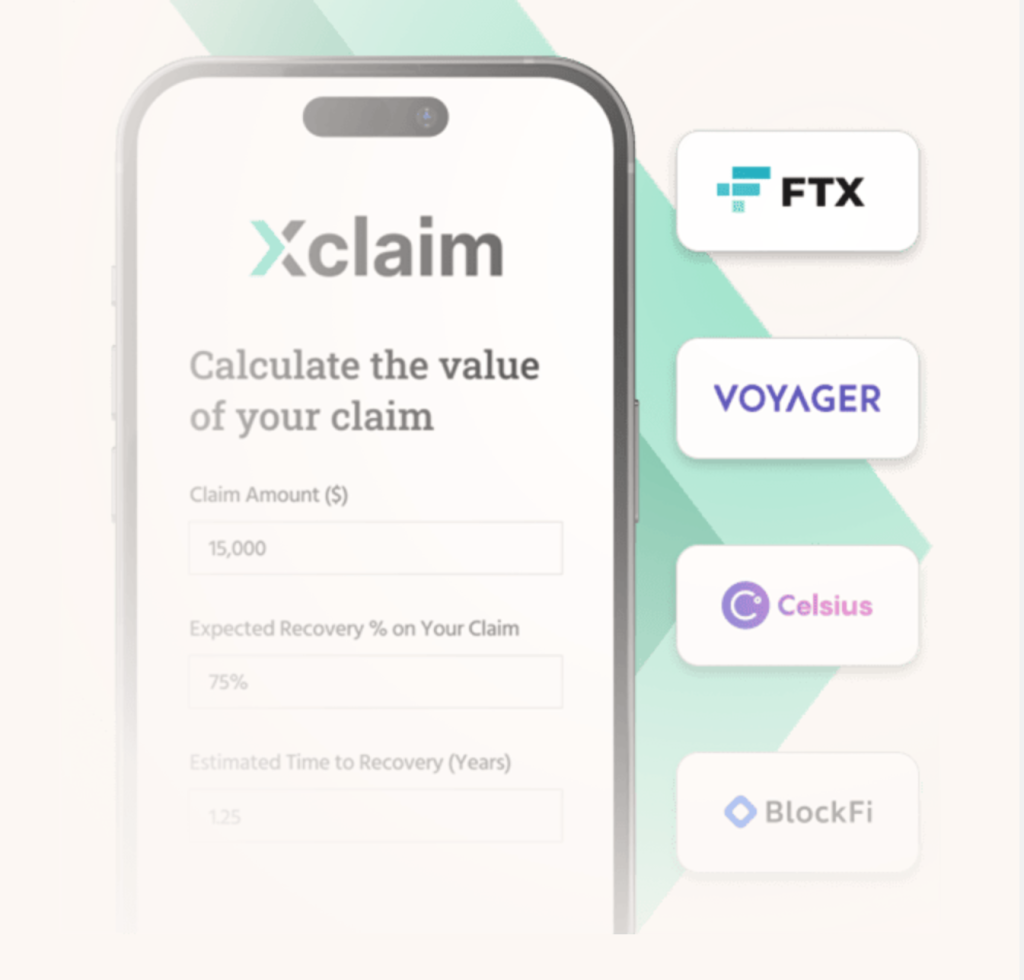

In addition to Cherokee’s platform, nearly 500 customers of the three platforms have also listed their claims, worth around $126 million, for sale on Xclaim, a bankruptcy claims trading start-up that recently changed its focus to buying and selling crypto claims. Xclaim has so far listed around $91.7 million in FTX customer claims.

On the other side of the transactions, hedge funds and distressed-debt investors are reportedly making calculated bets on the claims. Fund managers including Contrarian Capital Management, Invictus Global Management and NovaWulf Digital Management have reportedly bought claims from Celsius or Voyager creditors, according to court papers. These professional asset managers have the capital and time to ride out the bankruptcies, and they believe that they can make high returns by purchasing tokens with high upside potential.

However, it remains uncertain how much FTX creditors may recover in bankruptcy, and the case is reportedly more complex due to the lack of reliable financial information at the company and the criminal investigations faced by its founders. In addition, the pricing of the claims can change on a day-to-day basis, with some claims dropping significantly in value after the collapse of FTX and the failure of its deal to buy Voyager.

Despite the uncertainty surrounding the bankruptcy proceedings, some customers are still willing to sell their claims at discounted prices in order to receive some of their money back immediately. Vladimir Jelisavcic, the founder and manager of Cherokee Acquisition, stated that “some people need or want money now,” and that bankruptcy proceedings can take longer than people are willing to wait.

In addition to receiving some money back immediately, selling their claims also allows customers to lock in a loss in order to lower their tax liability. According to Ezra Serrur, the founder of hedge fund management firm Serrur & Co., selling accounts not only allows customers to receive some money back right away, it also lets them “lock in a loss to lower tax liability.”

On the other hand, buyers of the claims have their own considerations when purchasing the claims. In addition to analyzing the potential upside of certain tokens, they also consider the quality of the tokens in case they are not repaid through bankruptcy in dollars. Luxembourg-based investment firm NOIA Capital has reportedly purchased FTX claims by offering sellers two options: a 5% upfront payment of the value of the claims with 20% payouts when the accounts are repaid in bankruptcy, or a 2.5% upfront payment with 35% of future proceeds.

Overall, the sales of cryptocurrency claims through Cherokee’s and Xclaim’s platforms have so far only represented a share of the amounts owed to FTX, Celsius and Voyager customers. While these platforms allow customers to receive higher returns due to the transparent nature of the claims trading process, it remains to be seen how much these customers will ultimately recover through the bankruptcy proceedings.

Learn how to actually keep your crypto safe: https://coinvoyagers.com/trezor-model-t-supported-coins-list-2023-pros-cons-review-price-with-details/